How does Kudos show my credit card approval odds?Updated 24 days ago

Approval Odds shows you your likelihood of getting approved for each credit card before you apply. When browsing credit cards in Kudos (web or mobile app), you'll see one of four ratings:

- Excellent - Very high chance of approval

- High - Strong chance of approval

- Moderate - Fair chance of approval

- Low - Lower chance of approval

Important: Approval Odds Are Estimates

Approval odds are estimates based on available data, not guarantees. Card issuers consider factors beyond what's visible to third-party platforms when making approval decisions. Even platforms with direct access to issuer decision-making logic can't predict approvals with 100% accuracy.

Final approval depends on the card issuer's complete underwriting process, which may include:

- Income verification

- Employment status

- Existing relationship with the issuer

- Debt-to-income ratio

- Recent account activity

- Proprietary risk models

Applying for a credit card results in a hard inquiry that may temporarily affect your credit score, typically by 5-10 points.

How Are Approval Odds Calculated?

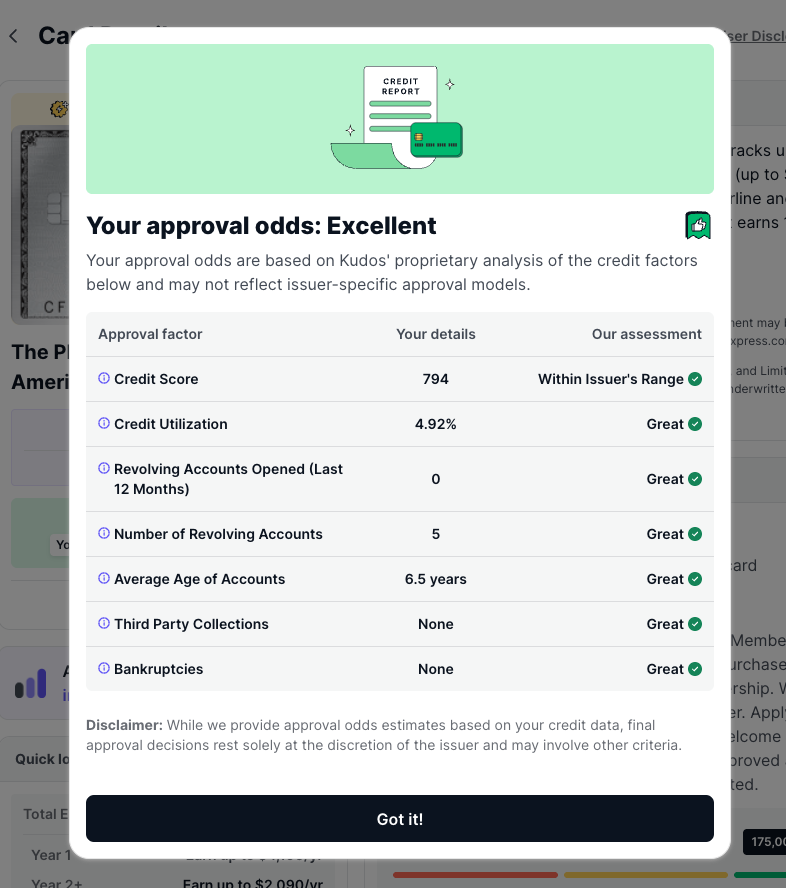

Your approval odds are calculated using your credit profile data that's already in your Kudos account, including:

- Credit Score: Your current FICO score

- Credit Utilization: Percentage of available credit you're using

- Account History: Length and depth of your credit history

- Recent Inquiries: New accounts and recent applications

- Chase 5/24 Status: Automatically tracked to help with Chase applications

How to View Your Approval Odds

On Web:

- Log in to your Kudos account

- Go to "Explore Cards"

- Browse any credit card - your approval odds will display prominently

On the Kudos Mobile App for iOS:

- Open the Kudos mobile app

- Navigate to the cards section

- View any credit card to see your personalized approval odds

Frequently Asked Questions

How often do approval odds update? Your approval odds update automatically as your credit profile changes, ensuring you always have current information.

How many cards show approval odds? Approval odds are available for over 3,000 credit cards in our database.

Will checking my approval odds affect my credit score? No, viewing your approval odds inside Kudos will not impact your credit score. However, submitting an actual application to the card issuer will result in a hard inquiry.

Are approval odds guaranteed? No. Approval odds are estimates based on your credit profile and available data. Final approval depends on the card issuer's complete underwriting process and factors beyond our data access. Even with "Excellent" odds, approval is never guaranteed. Always review terms and conditions before applying.

What if I'm denied despite high approval odds? We understand how frustrating this is. We're continuously working to improve our approval odds logic, but we can't eliminate all misses because card issuers use proprietary criteria we don't have access to. If this happens to you, please contact [email protected] - we're here to help.

What if my approval odds seem incorrect? If you believe your approval odds are inaccurate, please contact [email protected] with details about the specific card and your concerns.

Benefits of Using Approval Odds

- Avoid unnecessary hard inquiries - Focus on cards where you have stronger approval chances

- Strategic applications - Make informed decisions about which cards to apply for

- Check Chase 5/24 status automatically - No more counting cards manually

- Increased confidence - Apply with a better understanding of your approval likelihood

- Better planning - Understand which cards to target as your credit improves

Need More Help?

If you have questions about Approval Odds or need assistance with your Kudos account, reach out at [email protected]. We're always happy to help!